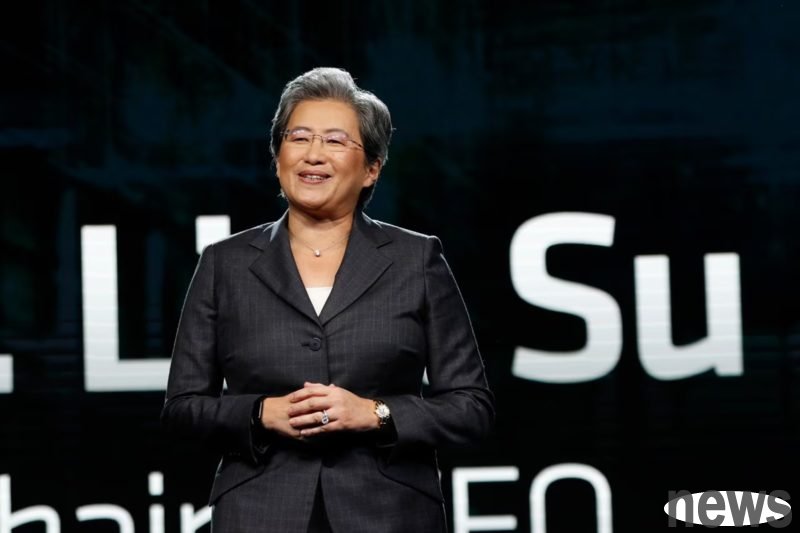

AMD s third-quarter financial results are impressive, but conservative fourth-quarter gross profit forecasts impact stock prices

Chip giant AMD announced its financial results for the third quarter of fiscal year 2025 after the market closed on November 4, 2025, Eastern Time. The report showed that AMD's revenue and EPS exceeded consensus market expectations. However, the company's adjusted gross margin forecast for the fourth quarter was only in line with market consensus. AMD's shares fell slightly in after-hours trading on the news.

AMD’s financial performance in the third quarter was outstanding, with revenue reaching US$9.25 billion, a significant increase of 36% from the same period in 2024, and higher than market expectations of US$8.74 billion. Net profit also climbed significantly to $1.24 billion, compared with $771 million in the same period in 2024. Adjusted EPS also came in at $1.20, beating consensus estimates of $1.16.

Looking ahead to the fourth quarter, AMD expects revenue to reach approximately $9.6 billion. The forecast implies annual growth of about 25% and beats the consensus estimate of $9.15 billion. However, in terms of net profit, AMD expects fourth-quarter adjusted gross margin to be 54.5%, a figure that is right in line with the 54.5% consensus market estimate. It is worth noting that AMD executives reiterated that this financial forecast does not include any revenue generated from the shipment of its Instinct MI308 chips to the Chinese market, which is consistent with the information they disclosed in the third quarter.

Analyzing the performance of each business unit, AMD's core growth areas performed strongly. In the data center business segment, the division covers standard CPUs as well as GPUs for artificial intelligence. Third-quarter revenue reached $4.34 billion, up 22% year-over-year, beating analysts’ expectations of $4.13 billion. Client business revenue reached $2.75 billion, achieving 46% annual growth and exceeding the market consensus of $2.61 billion. In the gaming business, revenue totaled $1.3 billion, a staggering 181% growth from the same period in 2024 and above the consensus of $1.05 billion.

Despite AMD’s excellent financial results and its active deployment in the AI market. However, the market's cautious attitude towards its future gross profit margin expectations caused the stock price to fall in after-hours trading. However, looking at full-year performance, AMD's stock price has risen by 107% as of the closing price of the previous trading day, far exceeding the 21% increase of the Nasdaq Index.

In terms of company shareholder dynamics, AMD's important cloud customer Amazon (Amazon) disclosed in a filing this week that as of September 30, Amazon had sold all 822,234 AMD shares it established in the first quarter of 2025. AMD CEO Lisa Su attended a hearing of the Senate Commerce, Science, and Transportation Committee on May 8, 2025, to discuss the wish list of technology company leaders to eliminate regulations that may hinder their growth and push business to China.