AI assists Tower Semiconductor s bright Q3 stock price hits a new high in more than 20 years

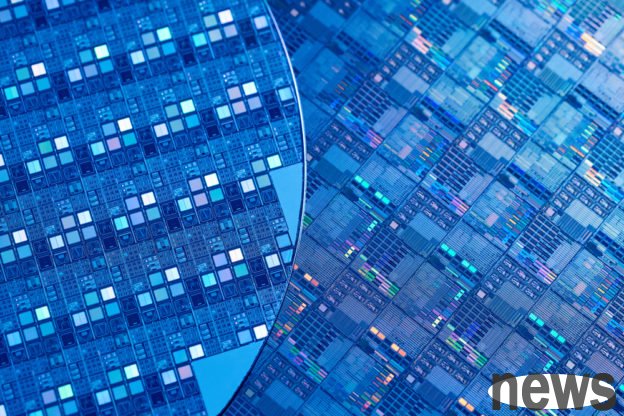

Tower Semiconductor, an Israeli wafer foundry, announced its latest financial report on November 10. Benefiting from the booming development of AI data centers, its third-quarter performance was strong. It also gave a fourth-quarter financial forecast that exceeded market expectations, inspiring the stock price to surge by more than 16% that day.

According to the financial report released by Tower Semiconductor, in the third quarter of 2025 (as of September 30, 2025), revenue reached US$396 million, which was higher than the US$370 million in the same period last year and slightly better than Wall Street's expectations of US$394 million; excluding one-time gains and losses, adjusted earnings per share were US$0.55, which also exceeded Wall Street's expectations of US$0.54.

(Source: Tower Semiconductor)

Looking forward to the fourth quarter, Tower Semiconductor estimates that its single-quarter revenue will reach US$440 million, plus or minus 5%, slightly higher than Wall Street's forecast of US$434.4 million. It is mainly optimistic that demand for AI and hyperscale data centers will continue to expand, which will support long-term demand for RF components and boost operating performance.

In addition, Tower Semiconductor announced that it will invest an additional US$300 million to expand silicon germanium (SiGe) and silicon photonics (SiPho) production capacity, while strengthening the research and development of new generation technologies, hoping to further seize high-speed optical communication business opportunities.

Gaota Semiconductor is a professional semiconductor foundry headquartered in Israel. It specializes in manufacturing semiconductor products for customers, which are used in consumer electronics, PCs, communications, automobiles, industry, medical equipment and other product fields.

On November 10, Tower Semiconductor’s ADR stock price surged 16.69% to close at US$98.10, setting a new high since 2004. It has soared 90.45% since the beginning of this year.

Further reading: Although Intel's acquisition of Tower Semiconductor failed, it was a blessing in disguise that the market value exceeded the acquisition price.