Is Trump s stake in Intel to attack Samsung or NTD? Market worries drag down US semiconductor competition

Foreign media reported that the news that the Trump administration in the United States is considering purchasing some shares of Intel, a US semiconductor manufacturer, to support the semiconductor manufacturer, which is currently in financial difficulties, has attracted high attention from the industry. Market analysts warn that this will challenge the competition between South Korea's Samsung and Telco and other Intel.

South Korea first drove the report and after US President Trump and Intel executive director Chen Liwu met in White House a few days ago, it revealed that the US government is considering the plan to invest in Intel. Trump considers using the funds from the CHIPS Act to invest in Intel to support the company that is regarded as the last hope for chip manufacturing in the United States. It is unclear whether this will convert Intel's existing chip bill grants into equity in part or in full and what time will it be implemented.

Analysts generally believe that the Trump administration's support is an obvious warning, which means that the orders of the US Technological Factory may be transferred to Intel, infringing on overseas competitors' market share. Jordan Klein, president of the US branch of Ruisui Securities, said the Trump administration could ask Broadcom, Qualcomm, Apple and NVIDIA to transfer more orders and production to Intel. Lee Jong-hwan, a professor of system semiconductor engineering at Korea's Xiangming University, also agreed that this would increase the opportunity for Intel to order orders from American technology companies. If the crystal OEM enters the formal business with the support of the government, it will be obviously unfavorable to Samsung's OEM business.

The Trump administration's actions have surpassed the single-purpose supplement and directly purchased Intel shares, highlighting the increasing degree of government interference in the global semiconductor competition, which has made the prospects of rivals such as Samsung Electronics and SK hynix in Korea even more complex. NH investment securities analyst Ryu Young-ho pointed out in a report that the U.S. blatant support for domestic companies is negative for competitors such as Taiwan Electric and Samsung Electronics. It is also emphasized that although Baigong has not issued an official statement, it is obvious that the US government is planning to operate important companies in the United States.

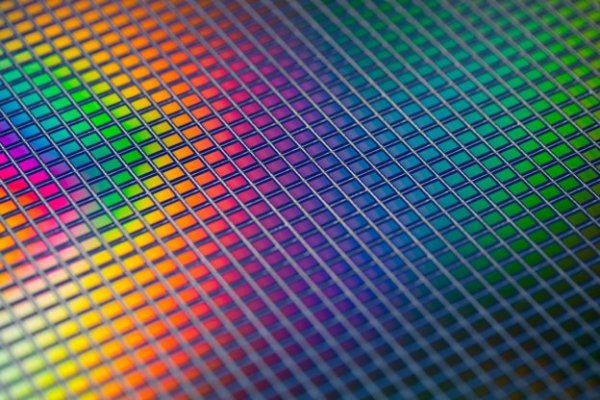

Intel is still dealing with severe financial difficulties. Its crystalline foundry business has been in a state of insecure every quarter since early 2022. As of the second quarter of 2025, its total losses have reached US$19.6 billion. In response to this situation, Intel has been cutting costs and laying off staff. Once the U.S. government invests in stake, Intel will accelerate the construction of Ohio semiconductor factory. The 2022 operation was originally scheduled to be completed in 2025, but it was postponed to 2030 due to fund shortages.

Jordan Klein also pointed out that Intel still has to say that there is competitiveness in serving customers. In the global crystal foundry market, Intel has almost no market share. In the first quarter of 2025, Taiwan Power's main market was ranked 67.6%, followed by Samsung, accounting for 7.7%. The Huaer Street Journal also pointed out that if government-imposed companies use Intel's chips, the yield and production capacity of Intel are lower than those of NT$1, which will make the yield and efficiency of the semiconductor produced in the United States in low volume, which will also weaken the overall competitiveness of the US semiconductor industry.