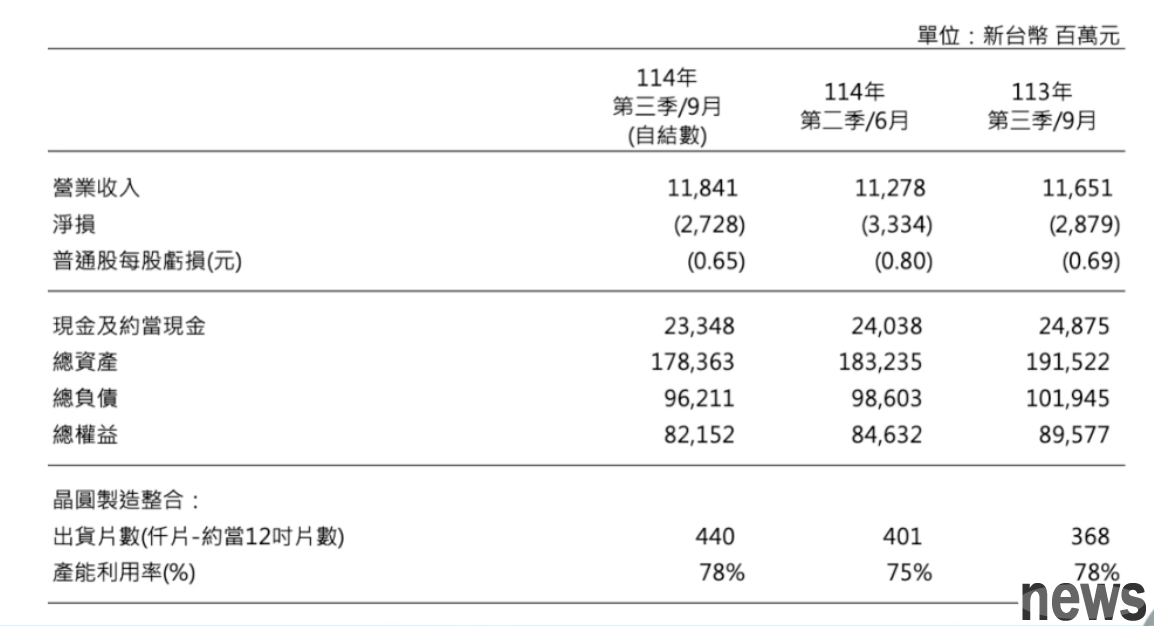

Q3 loss per share was 0.65 yuan! Power Semiconductor Manufacturing estimates that its wafer production volume and OEM prices will continue to rise in the fourth quarter, with momentum extending into t

Limited Semiconductor Manufacturing Co., Ltd. held a third-quarter press conference today (21st). General Manager Zhu Xianguo said that thanks to the increase in memory market prices, the company's operating performance has improved in the third quarter. It is expected that the production volume and DRAM foundry prices will continue to rise in the fourth quarter, and the trend will remain until the first half of next year.

Power Semiconductor's third-quarter revenue was 11.841 billion yuan, a quarterly increase of 5%; loss per share was 0.65 yuan, a slight decrease from the previous quarter; capacity utilization increased from 75% in the second quarter to 78%.

Zhu Xianguo pointed out that the supply of high-end memory for AI applications exceeds the demand, and AI-related memory and storage products represented by HBM continue to be in short supply. In the field of traditional memory, three phenomena have also been observed: first, niche DRAM. As wafer factories have prioritized transferring production capacity to high-value products such as HBM, niche DRAM production capacity has been severely squeezed and prices have continued to rise; SLC NAND Flash Benefiting from the production reduction strategies of major manufacturers such as Samsung and Hynix, prices began to rise in the third quarter. However, due to the lack of large-scale market demand for bids and the lack of killer new applications, the price increase was relatively mild.

In the NOR Flash part, with the rise of AIoT applications, the demand for low-power, high-reliability NOR Flash has increased significantly, and the market price has also seen a continuous upward trend recently. Zhu Xianguo said that due to rising market prices and a shortage atmosphere, overall memory customers' willingness to invest in wafers has become more positive in the third quarter. It is expected that while the supply gap continues to exist, both wafer production volume and product prices will continue to grow in the fourth quarter. This round of imbalance between supply and demand is expected to remain until the first half of next year.

Talking about the logic foundry sector, Zhu Xianguo pointed out that demand in the IT and consumer electronics markets is still conservative. After the National Day holiday, panel manufacturers adopted production control measures, and the overall capacity utilization dropped by about 5 to 10%, which was indirectly reflected in the supply chain. The mobile phone market is polarized. The new flagship phones released by various brand manufacturers from September to October stimulated high-end demand, but the buying momentum in the mid- to low-end market is still weak.

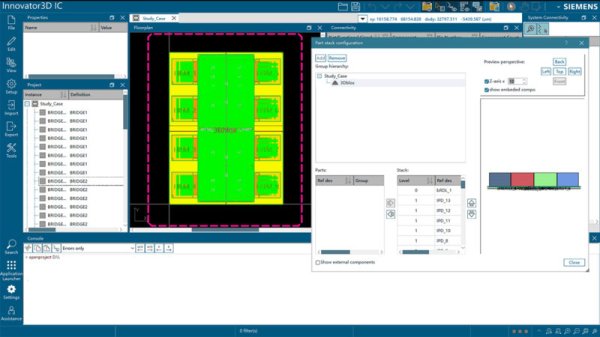

Looking to the future, Zhu Xianguo said that in terms of advanced packaging layout (WoW &&; Interposer), it has cooperated with many well-known manufacturers at home and abroad, and actively laid out key technologies such as WoW (Wafer-on-Wafer) 3D stacking and 2.5D silicon interposer applied in the AI field. In the third quarter, advanced packaging related product lines currently account for about 2% of total operating revenue.

In the WoW part, it has entered the Proof of Concept (PoC) verification stage with a number of customers, and mass production is expected to begin in the second half of next year; in the silicon interposer part, the customer NTO (New Tape Out) has shown positive performance and is currently actively entering trial production. The yield rate has climbed to the level of mass production. It will gradually expand wafer production in the future to meet the needs of AI chip customers for high-performance and high-density packaging.

Zhu Xianguo also believes that, benefiting from the AIoT trend, client verification in the NOR Flash field has made gains and is expected to gradually increase in volume by the end of the year; power management ICs and power components are still very important, especially applications in market segments such as AI servers and automobiles, which will remain the focus of the company's future operations.

When asked whether Nexperia's shipments were affected, Zhu Xianguo said that some small-volume products were affected, but no structural changes were felt. At present, except for TSMC's relatively good performance, the mature processes of foundries are generally mediocre, and their future visibility is not obvious. It is uncertain whether prices can be increased next year.

Talking about the 12-inch factory jointly built in India, Zhu Xianguo pointed out that after the construction of the new factory is gradually in place, more than 20 billion in royalties will be gradually accounted for. However, it is expected that mass production will be difficult in 2026, and we should wait until 2027 for the opportunity to see the new factory completed.

Further reading: To accelerate the semiconductor design and test process, Siemens launches new solutions Research: AI and advanced packaging drive the global foundry market, and TSMC maintains its leading advantage