TA: From February 27, if the Glazer family wants to sell 100% of Manchester United, they can force La Jue to agree.

Saudi government official and sports promoter Turki Alsheikh posted on social media that Manchester United is close to changing ownership. The Athletic explains the background of this week's incident and its potential impact.

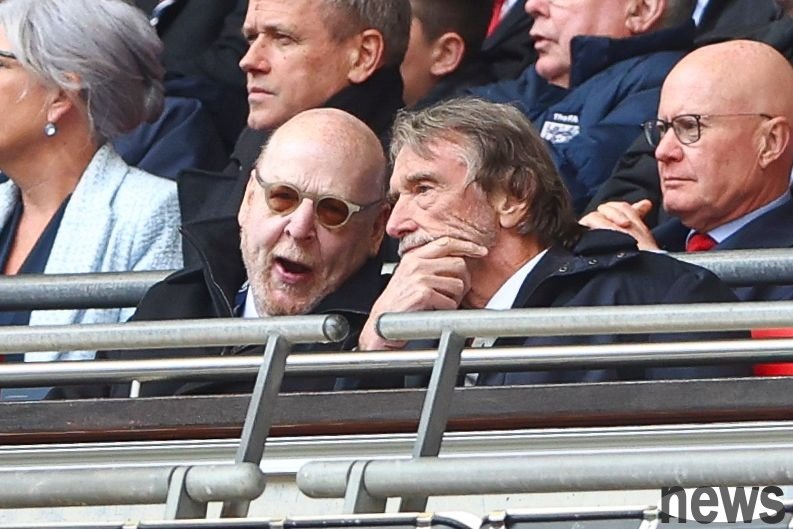

Manchester United's decision-makers held a regular executive committee meeting in Switzerland this week. These monthly meetings are chaired by co-chairman Sir Ratcliffe and are usually attended by at least one member of the Glazer family (Joel or Avram), Ineos executives and club chief executive Berrada. While last week's Premier League win over Sunderland eased the pressure on coach Amorim and raised the mood at the meeting, Old Trafford management are still aware of the tension among the fan base.

Manchester United rarely enjoys long-term peace. On Wednesday, Ratcliffe made his first full public statement on Amorim's position since March, saying he had "three years" to prove his coaching ability. That night, Saudi government official and sports promoter Al Sheikh posted on social media that Manchester United was close to changing hands. Although the club remained silent, the tweet sparked speculation about potential suitors over the next 48 hours.

What is the current ownership structure of Manchester United?

Manchester United's shares are divided into Class A and Class B. The current outstanding shares include 56.1 million Class A shares and 1.163 billion Class B shares, but only Class A shares are publicly traded on the New York Stock Exchange. The voting weight of Class B shares is 10 times that of Class A and is mainly held by the Glazer family - Joel (14.88%), Darcy (14.02%), Brian (13.16%), Avram (10.33%), Kevin (9.72%) and Edward (8.95%). Six family members collectively hold 71.04% of Class B shares and 3.04% of Class A shares.

This means that although the Glazer family only holds less than half of the total share capital, it controls 67.91% of the voting rights. Ineos Limited, controlled by Ratcliffe, holds nearly 29% of various classes of shares and corresponding voting rights. Under an agreement reached in February 2024, Ratcliffe pledged to inject $300 million (£238.5 million) into the club by the end of that year, thereby gaining control of sporting affairs, but his influence has extended to the commercial field, driving large-scale cost cutting and layoffs plans in the past 18 months.

In addition, Ratcliffe shows substantial influence in high-level decision-making. Although he is not on the Manchester United board of directors, many of his deputies are among them: Roger Bell, who became Manchester United's chief financial officer in May last year, once held the same position at Ineos; director John Rees and Ratcliffe jointly own Ineos; another director, Rob Nevin, serves as chairman of Ineos Sports. The current CEO Berrada was also appointed by Ratcliffe. He previously worked for City Football Group, a subsidiary of Manchester City.

Why is the topic of ownership heating up again?

On Wednesday night, Al Sheikh stated on social media that "Manchester United has entered the final stage of reaching a sale agreement with new investors" and expressed "the hope that the new owner will be better than the predecessor." There are endless rumors about Manchester United changing ownership on social platforms, but this time it attracted attention because of the special identity of the poster. He is the consultant of the Saudi Royal Court and the chairman of the General Entertainment Authority.

Al Sheikh is deeply involved in the Saudi sports industry and oversees the financing of major domestic sports events. His prominence allowed the tweet to go viral, with nearly 6 million views as of press time. On Thursday, he once again issued a message to clarify that he is not a potential investor and that the acquirer has a non-Saudi background: "As a fan, I hope that the deal will come true. Although it may not come true, the club has indeed entered an in-depth negotiation stage."

What is the Glazer family’s “right to drag out the sale”? Why is it important?

When the Glazer family sold a minority stake to Ratcliffe, documents filed with the U.S. Securities and Exchange Commission (SEC) detailed a "drag right" mechanism. The clause will be activated 18 months after Ratcliffe's initial investment, meaning the Glazer family can force him to participate in the full sale of Manchester United. This clause is essentially to prevent minority shareholders (here Ratcliffe) from blocking the transaction when other interested parties propose to acquire 100% of the shares.

If the Glazer family seeks a full sale before February 2027, the price per share must be higher than the $33 paid by Ratcliffe to ensure that the full investment can be recovered. After that period, Ratcliffe may be forced to accept any offer agreed to by the Glazer family, even if the sale price is lower than Ratcliffe's original purchase price per share, meaning his potential losses could amount to millions of pounds.

Is the sale in the interest of the Glazer family?

Whether there is a willingness to sell is a question worth billions, but the terms of the agreement signed with Ratcliffe show that it is in the interests of the Glazer family to complete the transaction before February 2027.

As mentioned above, if it is forced to sell before this, Ratcliffe will be guaranteed at least $33 per share held by him. The Glazer family will naturally demand at least equal consideration for its shares, thereby raising the transaction floor price. However, Ratcliffe's $33 per share guarantee will expire on the third anniversary of the investment, giving any potential buyer the opportunity to acquire the entire club at a lower offer. From a buyer's perspective, if the transaction is likely to be cheaper in 18 months, why should we pay a premium now?

Of course, if the Glazer family values Manchester United above $33 per share, Ratcliffe's terms will have limited impact, and they may only consider transactions above that price. But as of this writing, the publicly traded stock price is about $16, less than half of Ratcliffe’s acquisition price. Unless there are mandatory constraints similar to current terms, there is no guarantee that any buyer will make such a high offer again.

Manchester United's commercial prospects will be closely watched in the coming months. While the club recently posted record annual revenue, its commercial arm has undergone dramatic personnel changes. The Snapdragon and Adidas deals, which Ratcliffe calls "great partners," were driven by departed business executives Victoria Thompson and James Holroyd respectively.. Manchester United must also quickly refinance long-term debt left over from Glazer's leveraged buyout 20 years ago, and rising interest rates may increase the club's annual expenses by millions of pounds.

What is the valuation of Manchester United? How long does it take to complete the sale?

We cannot know the specific selling price of the club, but we can determine the minimum cost to acquire Manchester United before the right to sell off expires in February 2027. Ratcliffe's stake is equivalent to $33 per share (equivalent to £26 on the day of the transaction), and any transaction before the rights expire must reach at least this valuation level.

Even so, Manchester United's valuation will reach 4.3 billion pounds, becoming the most expensive club acquisition in football history. The "selling price" of Chelsea, the current record holder, is controversial: in the transaction completed in May 2022, the shares were sold for 2.5 billion pounds, and an additional investment of 1.75 billion pounds was promised, with a total valuation of 4.25 billion pounds. Lane Group, which had previously advised Ratcliffe on the acquisition, had quoted a price of $35.25 per share to the Qatari bidder. If existing shareholders demand the same consideration, Manchester United's valuation will reach 4.6 billion pounds.

Even if the transaction occurs after the minimum price guarantee of US$33 per share expires, the selling price is likely to be much higher than Manchester United's current valuation. As of Friday afternoon, Manchester United's share price corresponded to a market value of just 2.1 billion pounds.

Any acquisition is likely to be a lengthy process. Manchester United's status as a public company, not to mention one of the most high-profile sports teams in the world, means there is bound to be a lot of interest and a lot of compliance processes to go through. It is common knowledge that multi-billion pound sports team acquisitions require significant time, money and legal processes.

Where might the acquisition intention come from?

Most people first turn their attention to the Middle East. Sheikh Jassim bin Hamad Al Thani, the son of the former Prime Minister of Qatar, tried to acquire 100% of the shares at the same time as Ratcliffe, but SEC documents show that he has never been able to provide proof of funds. Qatar's interest may not subside, especially since it has the financial resources to overwhelm other regional bidders if it wants to.

Although Al Sheikh claimed that his tweet was not referring to Saudi Arabia, we know that Saudi Arabia and Manchester United have existing links: the two parties are negotiating to participate in a friendly match in Riyadh. There are also unconfirmed reports that a UAE consortium has also expressed interest. Other potential buyers could come in the form of private equity. Musk, the world's richest man and owner of X platform, has also been jokingly said that he wants to acquire Manchester United.